Trucking news and briefs for Thursday, Aug. 24, 2023:

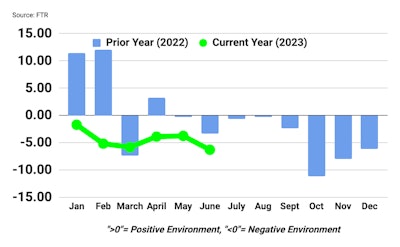

FTR's June Trucking Conditions Index fell to -6.29, the lowest since November 2022.FTR

FTR's June Trucking Conditions Index fell to -6.29, the lowest since November 2022.FTR

The fall-off reflects a modestly weaker market conditions for carriers, FTR noted. Freight rates were slightly less negative in June, but all other key factors deteriorated. June’s TCI reading was the most negative since November.

“Based on our assessment, for-hire trucking companies have already faced the longest period of consistently unfavorable market conditions since the Great Recession,” said Avery Vise, FTR’s vice president of trucking. “We expect negative TCI readings to continue for nearly a year longer and little, if any, improvement until early 2024.”

Vise added that market challenges “are not uniform, as the current market is hitting small carriers much harder than larger ones, especially considering the recent upturn in diesel prices.”

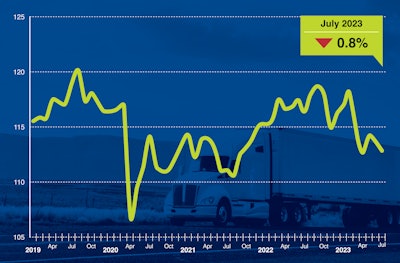

July's decrease in tonnage marks the fifth straight year-over-year decrease.ATA

July's decrease in tonnage marks the fifth straight year-over-year decrease.ATA

“Headwinds for freight remained in July, pushing the truck tonnage index lower,” said ATA Chief Economist Bob Costello. “As has been the case for several months, a multitude of factors have caused a recession in freight, including sluggish spending on goods by households as consumers traveled more and went to concerts this summer. Less home construction, falling factory output and shippers consolidating freight into fewer shipments compared with the frenzy during the goods buying spree at the height of the pandemic are also significant drags on tonnage.”